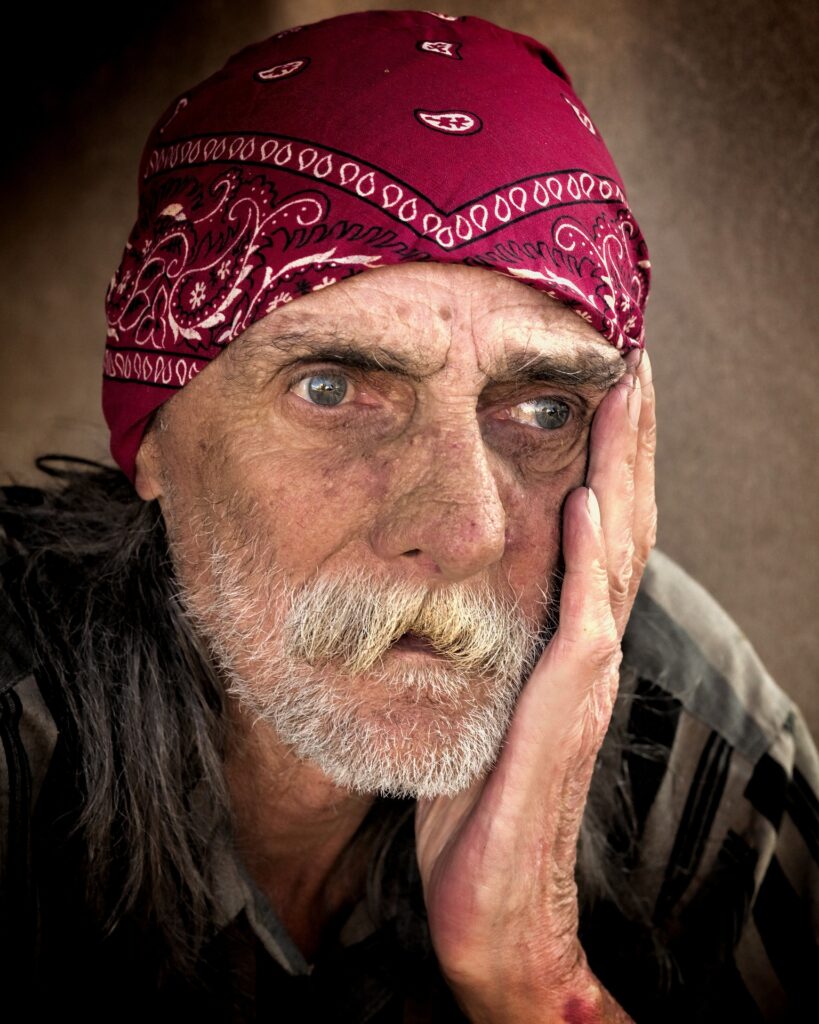

In this article we are going to talk about the why is it important to have a retirement plan. The cycle of life is unavoidable by every mortal. All living things are first born; they grow up and then finally grow old and die. The same cycle is followed by humans as well. Humans are born on this planet as babies, we grow up, complete our childhood and enter into teenage and after that follows the adulthood. Adulthood is the one stage of life where humans work for a living. They go to offices and work hard to earn money. The money earned is used for various essentials of life; it is used to buy food, clothing, a house and other essentials.

All of this is nice and fine until we start to age and then become too old and weak to earn money. We have to retire from our jobs, sit at home for the rest of our lives. Retirement is that phase of life where one steps down or withdraws him/her self from the current position they are holding either due to old age or due to their personal choices. Taking a retirement due to their own will is called as voluntary retirement or VR.

In countries like India, the age of retirement for the government sector jobs is 60 years, it varies from state to state and also for central government jobs. It also varies from profession to profession. The defence services have a retirement age of around 37-38 years if they’re on the borders. In today’s world, because it’s impossible for us to survive without money the government is giving pensions to the retired personnel so that it will help them with affording basic amenities like food, medicines and a house.

This is of great help for them because they need not be dependent on anybody. Retirement life is often called as a happy life or the only part of life without any worries or tensions, the only stage of life where you need not hustle for anything. You can just sit back and relax, spend more time appreciating the little details of life, spend time with your grandkids and tell them all sorts of stories. Retired people are known to enjoy life in their own style. According to the national portal of India, there are many advantages and benefits of retirement. You get leave encashment, provisional fund, and even retirement gratuity. These benefits allow the retired people to have a stress and a hassle-free life.

These retirement benefits and pension schemes vary from company to company and from country to country. Along with these benefits, it is also very important to have proper retirement schemes and retirement plans to have a stress free retirement. This is called “retirement planning”. In simpler terms, retirement planning is the process of determining and sorting the income, determining how and where the income will come from and how much. This also means sorting the money for emergencies and for essentials, estimating the unavoidable expenses and identifying the sure sources of income. Doing all of this will make your retirement life a very independent and hassle-free life. You can lead your retirement without any tensions and stresses.

Why is it Important to Have a Retirement Plan?

Here are some of the reasons why it is important for one to have retirement plans.

1. Medical emergencies

Medical expenses come unexpectedly and will take a huge hit on all your savings. During such emergencies, the retired people who have zero retirement plans will find it absolutely impossible to manage their expenditure or even afford the treatment. In such cases having a retirement plan and being fully prepared for the same will be a huge help for you as you can get the A-class treatment without even depending or relying on anybody. It is also difficult for the retired people to get loans from the banks at the time of need. They will find it very difficult in such cases. Having a fixed asset or a fixed source of income for such cases will come in handy for them. Having health insurance policies will also be a great help for the old and retired people.

Click Here: Interesting Articles to read when you are bored

2. Non-pensioners

It is a very obvious fact that not everybody is eligible for the pensions given by the state and the central government. The people who are entitled to receive it have very few financial problems when compared to those who get no pension from the government. Having proper retirement plans becomes very important to such people as they have to spend their entire retirement on the savings that they make. Retirement planning can mean many things, like having a savings account, having insurance policies, investing in stocks and mutual funds. These are all long term returns will be a great help in your retirement age. There will be cases where you retire with a lot of commitments still left to complete, they could be your children’s education, their marriage, etc.

Read Also: Different types of life insurance policy

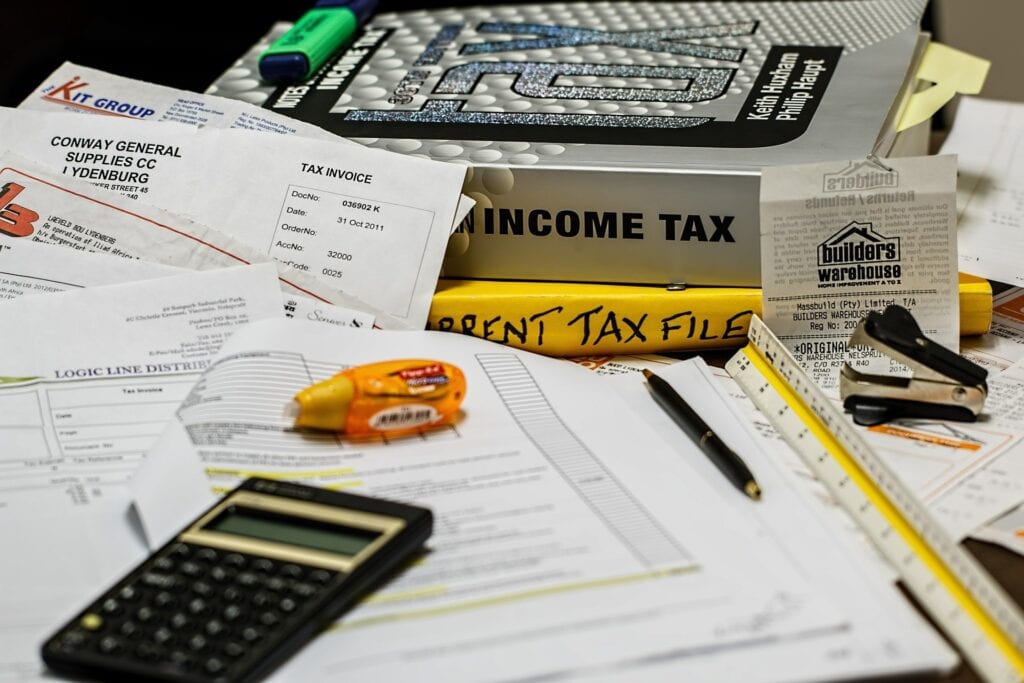

3. Unexpected inflation

With the growing competition in the world for literally everything, it is impossible to survive if you do not earn enough. Having solid retirement plans will not only help you have invested your salary in the proper place, but it will also give you assurance for a better tomorrow. The economy is never predictable in the country. There can be sudden inflation in the prices. This sudden inflation can be a major problem for those without any retirement planning. We can take into account the very peculiar case of the 2008 recession; it was a complete state of chaos all around the world with the United States being the epicentre of this. In such cases, retired people without any retirement planning will find it very hard to manage their livelihood.

Read Also: Benefits of buying an Apartment and renting it out

4. To maintain the same or better standards of living

People usually tend to have a poor standard of living when compared to the one they were having before retirement. This is mainly because they did not plan at all or plan enough for the future. Having nice and proper retirement plans, having adequate savings and other assets will help you have the same or probably even better standards of living. You will not have the need to compromise on anything in the future. You need not adjust or limit yourself for any kind of necessity or luxury that you have or you always wanted to buy. With the help of proper retirement plans, you can do everything you dreamed of doing but couldn’t because of many constraints and commitments.

Read Also: Why we should plan for our future?

5. Live independently

In today’s growing world, families keep getting more and more nuclear unlike the good old days where the concept of joint families was more acceptable. People lose their minds upon hearing the concept of joint families, in fact a family of six is also considered as a huge family. In such cases, the old and retired people cannot even expect anything from their children, they cannot expect them to look after them and feed them.

Although this is not the case in every house, this is the more general idea of people everywhere. In the families where the children are not ready to take care of their parents, or the parents do not want to be a burden on their children, the only way out for them is to invest in retirement plans. Having solid health insurance, a good number of sources of income, it could be from their pension or from house rents or even from mutual funds. To sum this up in a nutshell, having retirement plans will help you be independent even after retirement.

Read Also: Benefits of health insurance policy

6. To live life to the fullest

It is very common that most people out there don’t like their jobs, their bosses or even working so much. The only thing constantly running in their mind is to quit it all go on a vacation, enjoy life and live it to the fullest. This can be done if you have proper investment schemes done while you are earning. While you’re still in your working period, you can invest in retirement plans, in mutual schemes, stocks, and shares or even in chit funds. This will give you quick returns and help you have the money you need for having the time of your life during retirement. You can even take a voluntary retirement and do what you always wanted to do. Investing in retirement plans at a very early age will help you get more benefits at the time of retirement.

Click Here: Best Investment Blogs

7. Relying completely on pension is dangerous

There are many people who will tend to rely on the pensions that the government will be giving them and think it will be sufficient for them to survive the rest of their retirement on it. This is a very risky thing to do as the problems that will arise from this are limitless. There can be a delay in the arrival of the pension, there can be inflation, and the new government in power can pass a rule to revoke the entire pensioner’s money or even pass a bill to reduce the amount of money given to the retired. Any of these things is very likely to happen and solely relying on the pension amount is not advisable at all.

Read Also: What is life insurance and why it is important?

8. Tax benefits

There are some schemes which are called tax beneficiaries where you need not pay taxes as in you will be exempted from paying taxes. There are also schemes where you will be partially exempted from it. There is also the option of tax diversification. Here you will diversify the accounts and withdraw money from them depending on the circumstances.